How Arkady Rotenberg avoided sanctions. Part II – Latvia.

Recently we told you about the arrangement devised by Arkady Rotenberg to circumvent Western sanctions. The arrangement is quite simple. Rotenberg takes the trusted people from his team, who for many years have managed his indirect Western assets, and “removes” them from himself and the SMP Bank. The first such episode was the resignation of the bank’s chairman Dmitry Kalantyrsky, who moved to Prague, registered a number of companies there and bought real estate in the Czech Republic and Austria. Today we want to talk about Rotenberg’s second “emissary,” Denis Pospelov, who moved to Latvia.

Authorized representative in real estate development

Denis Pospelov came to the SMP Bank together with Dmitry Kalantyrsky in July of 2002, leaving Lefko Bank behind. Kalantyrsky was the chairman of the board, and Pospelov his deputy. As the information agency BankInformService reported, in 2005 Denis Pospelov became the first deputy chairman. He was responsible for IT development, financial analysis and treasury operations. He is Rotenbergs’ hired manager who works for the benefit of the brothers and their bank.

Denis Pospelov

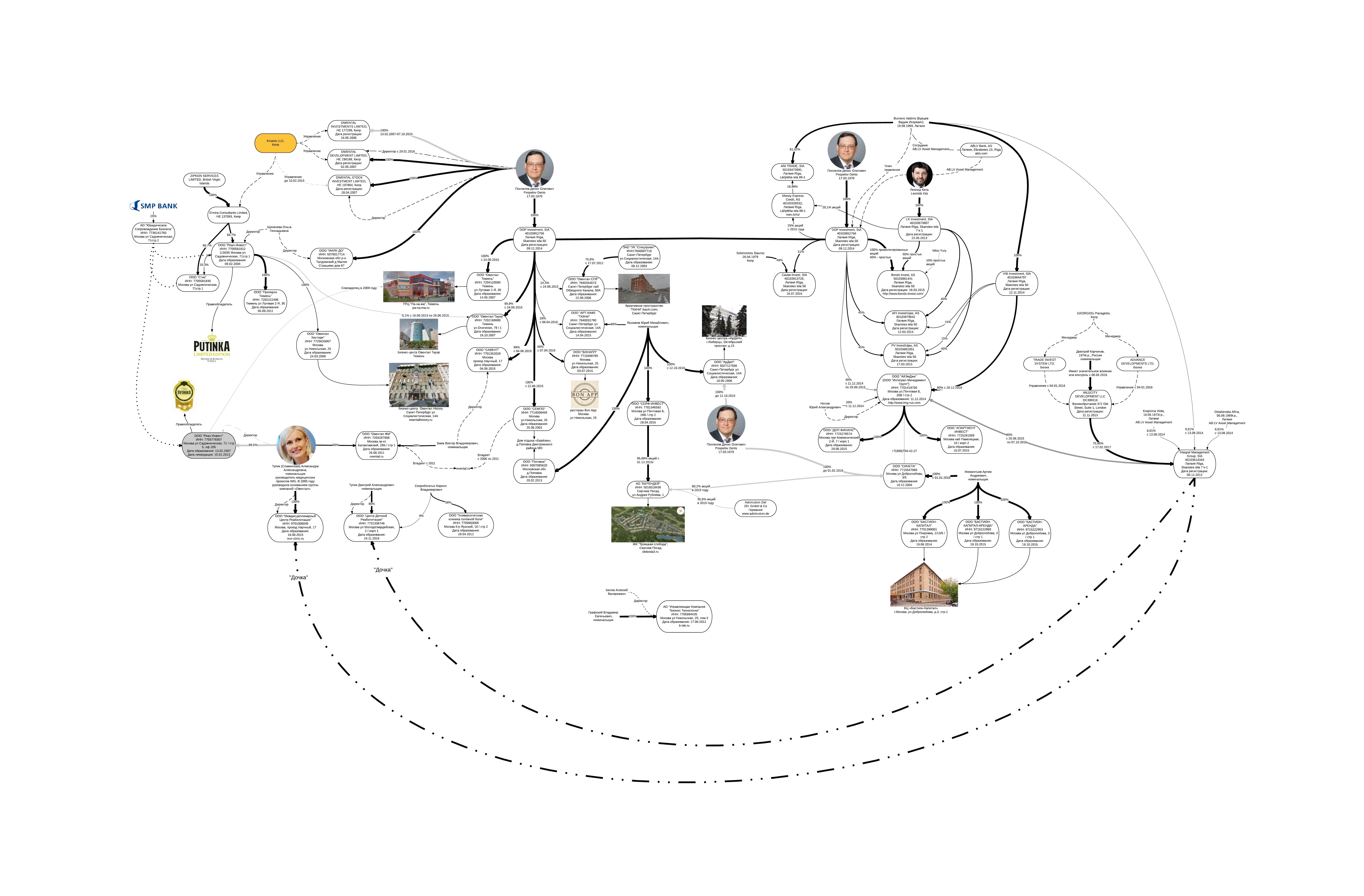

In 2006-2007, using the services of the already familiar legal firm Kinanis LLC, Denis Pospelov registered 3 Cypriot companies in his name: Owental Development Ltd, Owental Investments Ltd and Owental Stock Investment Ltd. This kicked off the creation of the Owental Group of Companies in Russia. Also in 2006-2007, Owental Development Ltd established companies in St. Petersburg (LLC Owental SPb, LLC Owental Ost), Moscow (SEMPO LLC, LLC Owental Entertaintment), and Tyumen (LLC Owental Tyumen, LLC Owental Tower).

Open the scheme in full size in a new tab

In 2010, LLC Owental SPb began reconstruction of St. Petersburg’s former spinning and weaving Anisimov Factory located at the Obvodny Canal embankment, and later used its territory to create the Tkachi (Weavers) Creative Space.

Photo of Tkachi Space

In 2013, the Tkachi Space hosted Marat Guelman’s exhibition Icons. The opening was scandalous: the building was covered in graffiti, the stalwarts of patriotism demanded that the exhibition is closed and wrote letters to the Rotenberg brothers. The goal was achieved — Owental broke its contract with Planet Media Group and the exhibition was closed.

In 2011, LLC Owental Os signed an investment contract with St. Petersburg’s Committee for Municipal Property Management. According to the contract, the mayor’s office provided Owental Ost with part of the building at Ligovsky Avenue 33 to be used for creation of a hotel, while Owental Ost was obligated to provide new apartments to the residents from the building’s other part. However, the contract was termintaed in 2012 by court order, and the company was liquidated.

At Tyumen, LLC Owental Tyumen had built the Pa-na-ma shopping and recreation center, and LLC Owental Entertainment opened the Multiland family recreation center there, but LLC Owental Entertainment itself went out of business in 2014.

Photo of the Pa-na-ma center

LLC Owental Tower had built the Owental Tower office building in downtown Tyumen. According to the SMP Bank’s annual report for 2012, construction was credited by the bank. TNK-BP’s research center moved into the Owental Tower, and the opening of the building was attended by Denis Pospelov as the “representative of the investor, chairman of the Northern Sea Route Bank.”

Photo of the Owental Tower

Separately from Denis Pospelov, the Owental Group of Companies incorporates several other legal entities. In 2008, LLC Owental History was established. It owns the Owental History office building in St. Petersburg.

Photo of the Owental History office building

LLC Owental History was established by Real Invest LLC, which is owned by the Cypriot company Ermira Consultants Ltd. Earlier, Ermira Consultants owned a share in the REN TV channel, and presently it owns a 3% stake in the 5th Channel-Petersburg TV channel and the rights to the Putinka vodka brand. But between 2007 and 2013 there was another Real Invest LLC, which also owned the rights to the Putinka vodka brand. The owner and director of this second Real was Alexandra Tupik (nee Slavyanskaya).

Alexandra Tupik

Alexandra Tupik started working for the Rotenbergs in 2005 and was directly involved in the creation of the Owental Group of Companies. According to the Unified State Register of Legal Entities, Alexandra Tupik was the foundder/co-founder/director of the following of the group’s companies: LLC Owental SPb, LLC Owental Tyumen, LLC Owental Tower, LLC Owental History, LLC Owental Ost, Property Tyupen LLC, Owental FM LLC.

In 2012, answering the question from Business Petersburg newspaper about investor of the Owental Group of Companies, Alexandra Slavyanskaya-Tupik said:

“It’s an institutional investor registered in the British Virgin Islands. That’s all that I can say about the founders.””

By 2012, the volume of investments amounted to $200 mln.

In 2008, Maxim Zuev, the general manager of the MultiLand family recreation center, said the following about its investors:

“Owental Ltd is the Russian subsidiary of the English investment company Owental Investments. The company was established by the natives of the USSR and Russia… Over the next five years Owental Investments plans to invest about $1 bln in business centers, shopping and recreation centers and spa hotels in Moscow, St. Petersburg and other regions of Russia.”

Our MiGs will land in Riga

In the spring of 2014, after Russia annexed Crimea, the US and EU began to implement sanctions against Vladimir Putin’s circle. The list included Arkady Rotenberg and the SMP Bank.

In May of 2014, Rotenberg, in order to avoid the sanctions, “sold” the Latvian Meridian Trade Bank, which the Rotenbergs acquired in 2008. The “buyers” were the bank’s management.

The Cypriot company Owental Stock Investments ran into problems. As Forbes reported:

“it quickly became clear that the bank no longer has access to the London Stock Exchange and Chicago Commodity Exchange, its dollar account in the JPMorgan Chase is frozen, and the Bank of America and American broker FXCM terminated their cooperation. The Owental Stock Investments hedge fund, connected to the bank’s owners, with assets of about $100 mln (according to the register, the fund is owned by the former employee of the SMP Bank Denis Pospelov), was unable to make transactions with derivatives. Bond transactions were also complicated — the largest clearing depositories Euroclear and Clearstream confirmed to Forbes that they adhere to the sanctions regime, but refused to comment on the situation with the SMP Bank.”

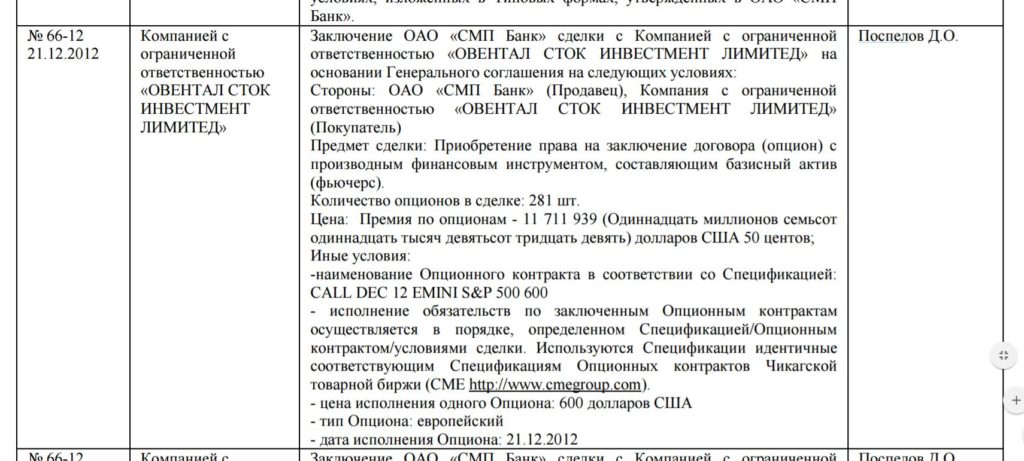

According to the SMP Bank’s annual report for 2012, Owental Stock Investments had a contract with the bank to carry out financial market transactions for its benefit.

In May of 2014, media reported that Denis Pospelov resigned from his position at the SMP Bank. There was no explanation offered and no subsequent news of the new job.

Denis Pospelov moved to Latvia, where he began to registered legal entities.

It should be mentioned that the Rotenberg brothers have long been interested in Latvia. In addition to the acquisition of the Meridian Trade Bank, in March of 2013 Boris Rotenberg bought a 100% stake in the Latvian company IMNI, SIA, which owns an estate on the outskirts of Riga. In August of 2014, IMNI, SIA was transferred into the ownership of the citizen of Finland and Great Britain Roman Rotenberg, Boris’ son.

In December of 2014, Denis Pospelov registered at Riga a company called DOP Investment, SIA, and began transferring the Russian assets to its ownership. On June 24, 2015, DOP Investment, SIA became the sole owner of LLC Owental Tyumen, and the owner of 99.9% stake in LLC Owental Tower, and 24.3% stake in LLC Owental SPb. On June 4, 2015, the Latvian company became the owner of 99% stake in SAVENT LLC, and on June 22 it got the 100% stake in SEMPO LLC. On April 7, 2016, it acquired a 60% stake in BONAPP LLC (owns a restaurant in Moscow’s Nautilus shopping center), and on April 8 — a 20% stake in TKACHI ART CAFE LLC.

In 2016, Denis Pospelov “bid farewell” to his other two companies in Russia. In February, SINETA LLC, which was established to manage the Bastion-Capital office building, was transferred to the nominee Artem Inokentyev. The Bastion-Capital office building is located in Moscow, and it leases offices to the federal state budgetary institution Federal Agency for Legal Protection of Military, Special and Dual-Purpose Intellectual Properties (subsidiary of Rospatent).

In October of 2016, ArDeN LLC was transferred to another nominee, Yuri Yashnikov. This company owns the ArDeN office building in the city of Lyubertsy, and its offices are rented out to the Interregional Territorial Department of Air Transport of the Central Regions of the Federal Air Transport Agency. Yuri Yashnikov is also the co-owner of TKACHI ART CAFE LLC, and at the end of 2015 he used SEIF-INVEST LLC to acquire 95.89% of shares in JSC BERENDEI, which was earlier owned by Pospelov’s company SINETA LLC and the German firm Adcirculum Ziel 20+ GmbH & Co.

JSC BERENDEI is engaged in construction of the large residential complex called Troitskaya Sloboda, at the town of Sergiev Posad, in the Moscow Region.

Troitskaya Sloboda

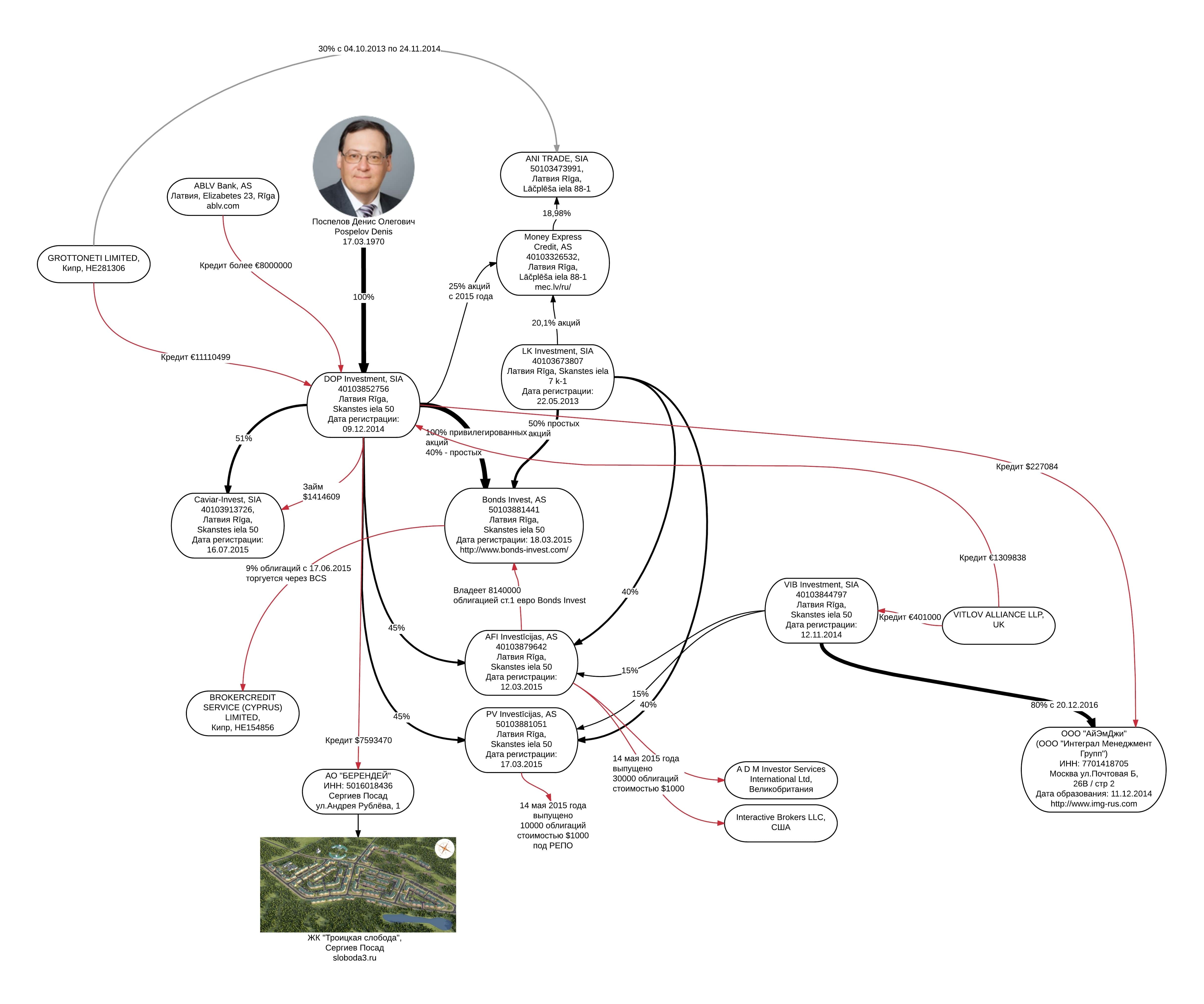

To help him with managing the companies’ activities in Latvia, Denis Pospelov went to the ABLV Bank. ABLV Bank provides its clients with such services as asset management, brokerage, investment services and asset protection. Pospelov issued a letter of attorney in the name of Leonid Kil (Leonīds Kiļs), while all of the financial reports of DOP Investment, SIA are submitted and signed by Vadim Burtsev (Vadims Burcevs), who is denoted as member of the board.

Leonid Kil and Vadim Burtsev are the employees of the bank’s division engaged in asset management, called AB.LV Asset Management. Leonid Kil owns the company LK Investment, SIA; Vadim Burtsev is the owner of VIB Investment, SIA.

Leonid Kil

Half of Denis Pospelov’s companies in Riga are registered at the address Skanstes iela 50, which houses the Latvian Service of State Control and the office of Dinamo Hockey Club. In case you have forgotten, Arkady Rotenberg has been the chairman of the Russian Hockey Federation since 2015, and between 2012 and 2015 he was the president of Dinamo Hockey Club (Moscow).

On March 12-18, 2015, the companies DOP Investment, SIA; LK Investment, SIA and VIB Investment, SIA registered three joint-stock companies:

- Bonds Invest, AS

- AFI Investīcijas, AS

- PV Investīcijas, AS

On May 14, 2015, AFI Investīcijas, AS issued bonds worth $30 mln, which are traded in the Great Britain (ADM Investor Services International Ltd) and the US (Interactive Brokers LLC).

On May 14, 2015, PV Investīcijas, AS also issued bonds worth $10 mln, which were earmarked for repurchase agreements.

Bonds Invest, AS issued bonds on June 17, 2015. Bonds for a sum of $8.1 mln are owned by AFI Investīcijas, AS. 9% of the Bonds Invest, AS bonds are traded on the market through the Russian company BrokerCreditService.

Open the scheme in full size in a new tab

Also, according to the financial reports, in 2015, DOP Investment, SIA took from the ABLV Bank a number of loans worth over €8 mln pledging as security 8 real estate objects in St. Petersburg and guaranteed by Denis Pospelov, LLC Owental SPb, PV Investīcijas, AFI Investīcijas and ZAO UK Spetsproekt company.

In addition to this, DOP Investment, SIA secured credits from the Cypriot company Grottoneti Ltd (€11.1 mln) and the British Vitlov Alliance LLP (€1,3 mln). Grottoneti Ltd is owned by the Cypriot legal firm S.I. CYLAW SERVICES LIMITED. Grottoneti Ltd owns a dozen companies in Latvia, and Leonid Kil is involved in those companies’ operations. The ultimate owner of Vitlov Alliance LLP is unknown, and the management is carried out by two companies from Belize: Advance Developmets Ltd and Coprporate Solutions Ltd.

In 2015, DOP Investment, SIA itself had provided JSC BERENDEI, which is building the Troitskaya Sloboda residential complex, with a credit worth $7.5 mln, and also gave out a credit to the Russian firm LLC Integral Management Group.

The eponymous Latvian company Integral Management Group was, until February 2017, owned in turns by LK Investment and Grottoneti Ltd, as well as by other employees of AB.LV Asset Management. But in 2017, its principal stake was transferred to the nominee Dmitry Korchinov via the British Milecity Development LLC. Dmitry Korchinov is the founder and director of several companies in St. Petersburg.

In December 2014, Integral Management Group, SIA and DOP Investment, SIA registered in Russia a eponymous company LLC IMG (LLC Integral Management Group). In December 2016, 80% of IMG shares were re-registered to Burtsev’s VIB Investment.

According to LLC IMG’s website, the company manages assets, makes investments in Russia and the EU, manages and builds real estate. And what are their specific projects? They manage the objects of the Owental Group of Companies and are building the Troitskaya Sloboda.

It should be noted that LLC IMG is not the only company to manage this real estate. It is also done by the Business Technologies asset management company, which is owned by nominee Vladimir Grafsky. The objects partially overlap with those of LLC IMG.

The Business Technologies asset management company also manages ZAO UK Spetsproekt, which owns 75.6% of shares in LLC Owental SPb. In particular, the lawsuits against negligent tenants of the Tkachi creative space are brought to court by ZAO UK Spetsproekt. Alexandra Tupik used to be the director of ZAO UK Spetsproekt until April of 2014.

Business Technologies asset management company, Bonds Invest and ABLV are all specified as partners on the website of LLC IMG.

In December of 2015, Vedomosti business daily wrote:

IMG Russia, a subsiary of the Latvian Integral Management Group (IMG), plans to establish in Russia a network of multipurpose rehabilitation centers. The network will operate under the brand Interdisciplinary Center of Rehabilitation (ICR), and representative of ICR and head of IMG’s medical projects Alexandra Slavyanskaya told Vedomosti that investments in its development will amount to approximately €30 mln… The representative of ICR said that a children’s clinic (for kids from 2 to 16) is already operating under this brand at Rublevskoye Highway, and the first adult clinic with an area of 2,500 m2 is scheduled for opening in February 2017 in the south-west of Moscow. Investments will amount to €5 mln of company’s own funds.

In August of 2015, LLC Interdisciplinary Center of Rehabilitation was registered in Moscow. Its 100% owner and director is the already familiar Alexandra Tupik (Slavyanskaya). In November of 2015, LLC Center of Children’s Rehabilitation appeared. It is 80%-owned and managed by Dmitry Tupik.

DOP Investment, SIA also provided a credit of $1,414,609 to the company Caviar-Invest, SIA, which is 51% owned by DOP Investment and 49% — by a Cypriot nominee.

In addition to this, Pospelov acquired a 25% stake in Money Express Credit, AS, which provides Latvians with microcredits at exuberant interest rates, leases cars, transfers money and operates pawnshops. The “partners” are the same, Kil and Burtsev.

Reaction

Vadim Burtsev’s comment to the Latvian TV3 channel, Nekā personī TV show:

“I have no information that would confirm your concerns that the financial assets are connected with the business of brothers Rotenberg. Moreover, Pospelov had worked at the SMP Bank even before the Rotenbergs gained contol over it and left it before the Rotenbergs came under sanctions… Denis Pospelov is making personal investments on the international financial markets, using different financial instruments — bonds and derivatives, available on the international stock exchanges. After evaluating the economic efficiency of completed work, the attractiveness of Latvia’s tax code, and the availability of necessary experts, Denis Pospelov decided to establish in Latvia a number of companies to manage his private capital… Get in touch with us if you need additional information.”

Vadim Burtsev refused to answer additional questions, saying that he has nothing to add.

But let’s look at what we have.

- Burtsev begins his answer with a deliberate lie, because Pospelov came to the SMP Bank together with Kalantyrsky, in July of 2002, a year after the bank was bought by Arkady Rotenberg. He left it on April 30, 2014, 2 days after the SMP Bank found itself under US sanctions.

- From the moment of its creation, Denis Pospelov did not hide his affiliation with the Owental Group of Companies, but claimed that its investors were some natives of the USSR, hidden behind the BVI companies. However, almost all of the companies were registered to Pospelov, an employee of the SMP Bank. Now, years later, Burtsev tells us that Pospelov himself was the mystery investor that planned to invest $1 bln in real estate construction back in 2008.

- In the course of his career, Denis Pospelov never acted for the benefit of his personal business, all of his actions were in favour of the SMP Bank, where he was a hired employee, and the Rotenberg family.

Conclusion

- When the US sanctions against Arkady Rotenberg came in effect, Arkady realized that shit hit the fan.

- By the early 2015, the team of Dmitry Kalantyrsky had put a maximum distance between itself and Rotenberg and the SMP Bank. Kalantyrsky had moved to the Czech Republic, Pospelov — to Latvia.

- Dmitry Kalantyrsky is registering companies, buying real estate and hotels in Austria.

- Denis Pospelov, who was responsible for the creation of the Owental Group of Companies, registers companies in Latvia and re-routes the assets to them. He is assisted by Leonid Kil’s team from ABLV.

- Through Pospelov, Rotenberg has the ability to use Western financial instruments, access to which was cut off by the sanctions.